24/25 Annual ISA Tax Allowances

Posted by Rebecca Harbrow on Friday 14th March 2025.

ISAs offer flexible, tax efficient savings and are a good way to make your money work harder for you.

Everything earned from your ISA is free from Income and Capital Gains Tax – in other words, you won’t pay tax on interest, withdrawals or growth. You can invest a total of £20,000 into one ISA or multiple ISAs in the 2024/2025 tax year. ISAs are also an easy and straightforward way to invest into stocks and shares.

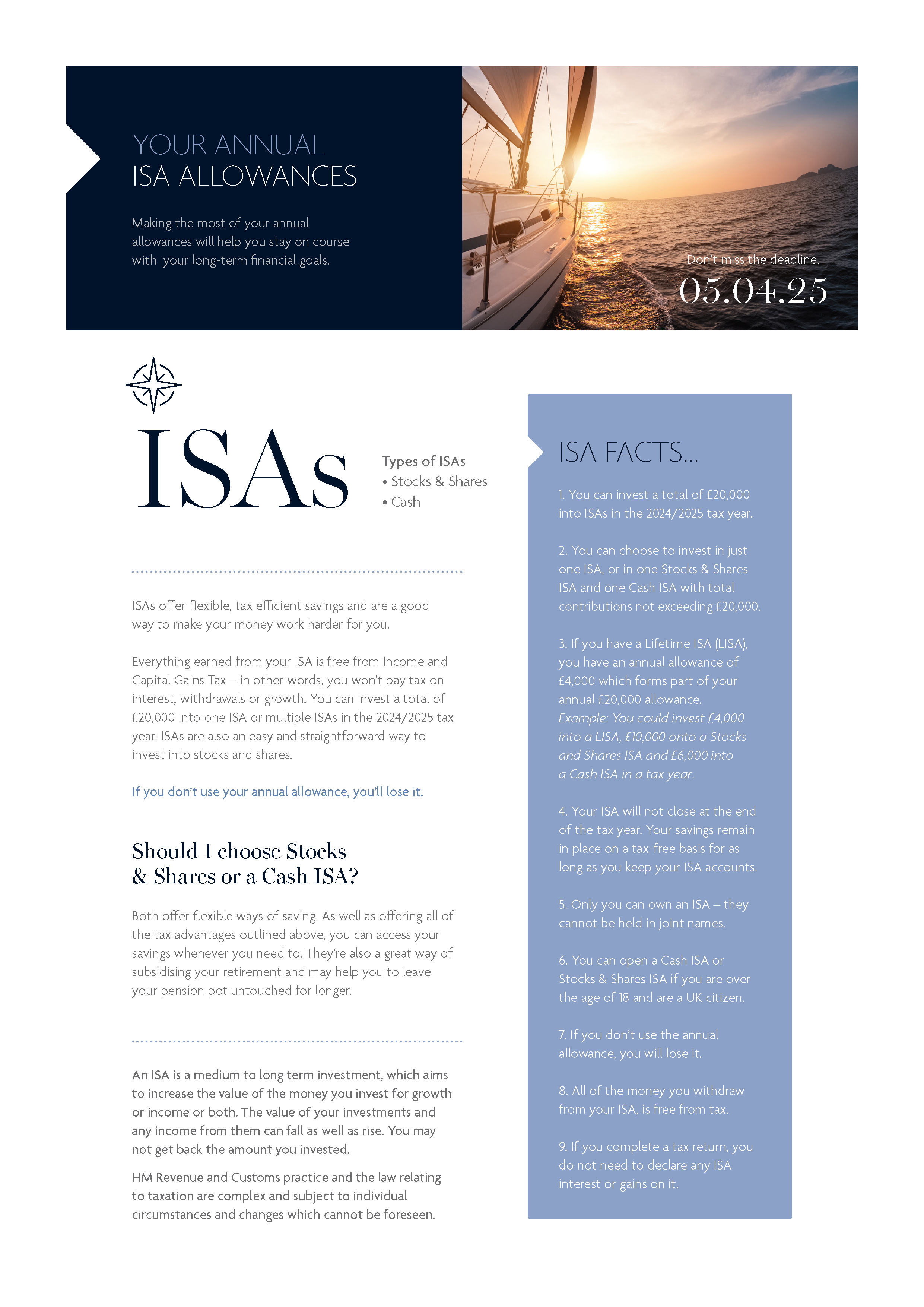

If you don’t use your annual allowance, you’ll lose it. Take a look at our handy guide by clicking on the image below

Archive

-

2025

-

October

-

September

-

August

-

July

-

June

-

May

-

April

-

March

-

February

-

January

-

-

2024

-

December

-

November

-

October

-

September

-

August

-

July

-

June

-

May

-

April

-

March

-

February

-

January

- Additional Health Services Included in your Protection Insurance

- Mortgages

- How Financial Advice Adds More Value to your Life than you may realise

- Make The Most of Your Income By Taking Advantage of The Tax Allowances Available to You

- VouchedFor Reviews - Latest

- Earn: How to Make The Most of Your Income Today and Save Enough for Tomorrow

-

-

2023

-

December

-

November

-

October

- Five practical ways to protect your money during the cost of living crisis

- Why having an emergency fund matters and where to hold extra cash reserves

- Why a plan is crucial when you start to spend your wealth

- Is Drawdown Right for You? Two Important Questions to Consider

- Remortgaging as a landlord: what to consider with a Buy to Let mortgage

- 3 useful ways to manage your finances and boost your financial wellbeing

- What's the Difference Between a Product Transfer and a Remortgage

-

September

-

August

-

July

- Income protection – one little change you can make to protect your family’s financial future.

- Finances and increasing energy bills

- Life after your Fixed Rate mortgage.

- Investing for Growth and Value

- How Long to Invest

- Make sure you have the right protection insurance

- Busting remortgaging myths: Your circumstances have changed – will you be able to remortgage?

-

June

- Worried about mortgage lenders withdrawing their products and deals?

- Is it better to gift a property or leave it in your will?

- Base Rate Rise June 2023

- Mortgage Affordability

- 5 practical ways to make your pension go further during the cost of living crisis

- Regular Investing

- Life after your Fixed Rate mortgage: Should I remortgage when my fixed rate ends?

-

May

-

April

-

March

-

February

-

January

-

-

2022

-

December

-

October

-

September

-

August

-

July

-

June

-

May

-

April

-

March

-

January

-

-

2021

-

December

-

November

-

October

-

September

-

August

-

June

-

May

-

April

-

February

-

January

-

-

2020

-

December

-

November

-

October

-

September

-

August

-

July

-

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.