Budgeting Tips for Saving Money While Making your Life Better

Posted by Rebecca Harbrow on Friday 29th July 2022.

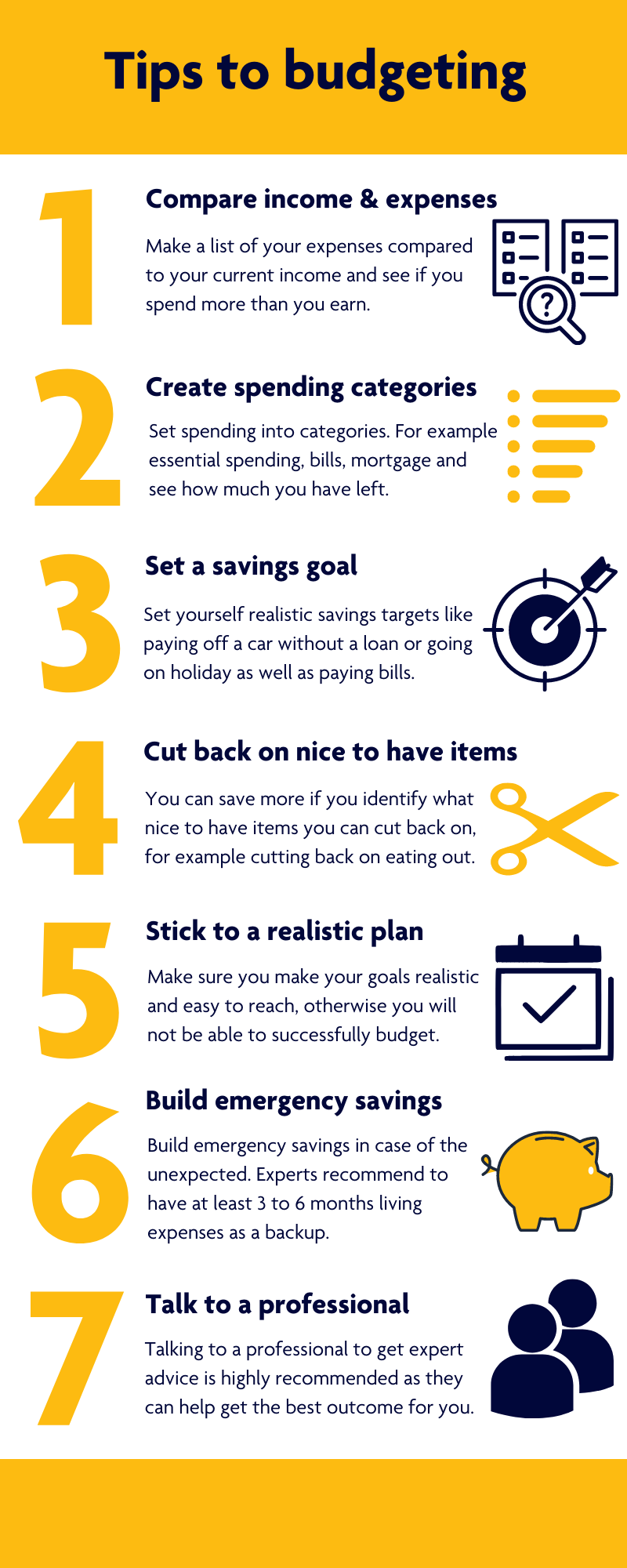

Whether you want to go on holiday or just want to save some money for the future, budgeting is a good way to put aside some money for reaching this goal. Here you can find some tips to help you take control of your finances.

Why is budgeting so important?

You might think it’s not worth spending that much time counting all your income and expenses. But if you use apps or spreadsheets to make it visible how much you earn and spend on average every month, it will pay off.

In case of the unexpected or just having a big expense, it’s important to have some savings not to become indebted.

How to start budgeting?

First, you will need to count how much money you bring home on average. Don’t forget to take your benefits into consideration as well so that you can put down the precise number.

After you become aware of how much you earn every month, it’s necessary to count your average monthly expenditure too. Don’t forget to look at at least three months of your expenses to be able to see some trends.

If you know your income and your expenses, you can compare them in order to see whether you spend more than you earn or not. If there is some money which remains every month then it’s easier for you to make a savings account. If you earn less than you spend, try to cut back on your expenses not to get into a debt spiral (spending and borrowing in turn).

In case of having debts and savings at the same time, it may be a good idea to pay off the one with the other, because for loans the interest rates are higher so you earn less with the savings interests than you have to pay for the loan’s interests.

What kind of costs do you have to count on?

If you know how much money you spend every month, you can set up categories to see the amount of your needs and wants. First count the essential spending, for example, the rent, utility bills and mortgage. These are your needs which you can’t leave out of your expenses. Although there are some tips to cut back on utility bills you can also include them in your budgeting.

In order to set budgeting goals, you also need to know how much you spend on nice-to-have items like meals or holidays. You can save more if you tackle the biggest costs, for example, eat-outs. From a financial aspect, it’s better to cook for yourself and your family than have a meal in a restaurant. When cutting back on costs don’t forget to remain the things in your budget you really love within your means. It’s also important that you don’t concentrate on a typical month to work out the amount of your disposable income and set your financial goal according to this.

After you have set your financial goals, you can concentrate on the third main category of where your income gets into. It’s necessary to build some emergency savings in case of the unexpected. Experts recommend to have at least 3 to 6 months of living expenses as a backup, but to have £1000 is already a good start.

How to set your budgeting goals?

When you set your budgeting goals it’s good to use the 50/30/20 rule where the biggest category is the essentials, the next one is the fun stuff and the last one is the savings. So try to split your income according to the percentages each category gets.

Try to set realistic financial goals, so don’t forget to build in a buffer to be able to adapt to the rising prices as well. Make the plan together with your family so that it will be easier to stick to the plan. Don’t forget to review your budget from time to time. With this checking, you’ll see whether you need to change your goals and where you could still cut back on your expenses.

You can also use piggy banking to automate spending. You can set spending categories, create a jar/piggy bank/account for each one and don’t exceed the amount of money you have there while paying for items within these categories.

If you’d like to discuss your budgeting goals, we’ll be happy to help.

Key takeaways

- Budgeting and saving is important to be able to cover unexpected expenses.

- First, count your monthly average income and expenses and compare them.

- Cut back on your expenditures to earn more than you spend. Next set up a savings account as well to have some backup.

- Set realistic financial goals to be able to stick to the plan.

- Use a budget planner or spreadsheet to make your finances more visible.

- Professional advice can help increase your savings and improve your budgeting.

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.