Why homebuyers need to check their credit score

Posted by Rebecca Harbrow on Friday 22nd July 2022.

Carly and Steve made serious sacrifices to save a deposit for their first home. To cut costs, they moved from their two-bedroomed flat in the centre of Manchester to a studio flat in one of the less well-regarded suburbs. When the damp and the noisy neighbours got too much, they moved in with Steve’s mum and when her questions about when they were going to start a family got too much, they moved in with Carly’s big sister.

As well as moving home three times in the space of a year, Carly and Steve gave up takeaways, holidays and their gym memberships. When they finally had enough money for a deposit, they couldn’t apply for a mortgage fast enough. They were crushed when their application was rejected due to a poor credit score.

A good credit score is vital for homebuyers, as this is how lenders assess how much of a risk you pose. The UK has three main credit referencing agencies – Experian, Equifax and TransUnion. They use your personal banking information to assess how well you manage credit. This is summarised in a credit report and by a single number - your credit score. Lots of things can affect your credit score, including moving house frequently, which is seen as a red flag as it can be a sign you’re struggling to pay your rent. So, as well as avoiding frequent changes of address, what can you do to make sure you don’t end up in Carly and Steve’s position?

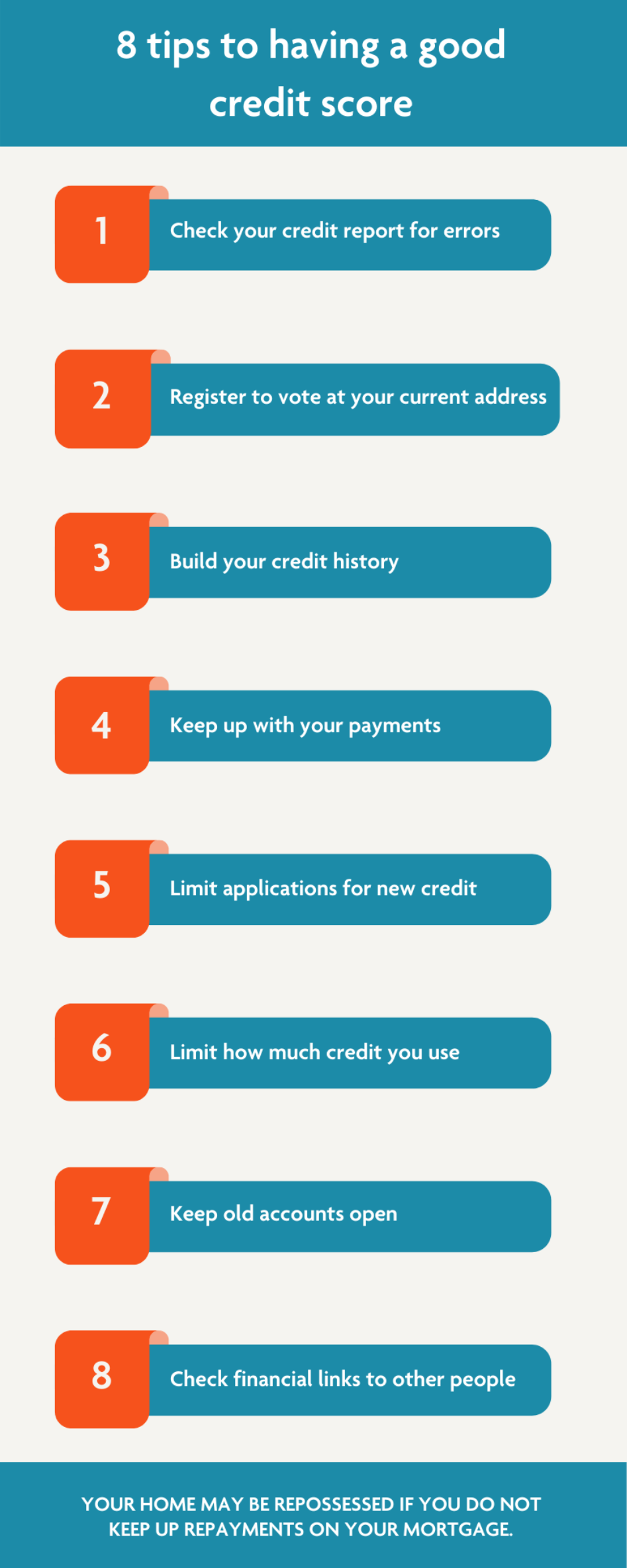

Check your credit report for errors

Even small mistakes, such as a mistyped address, can affect your credit score. If anything looks wrong, contact the credit referencing agency to correct it.

Register to vote at your current address

This proves where you live and can add 50 points to your credit score, according to Experian.

Build your credit history

Having little or no borrowing history may result in a lower credit score. You can build your credit history by opening a current account, setting up Direct Debits or getting a credit-builder credit card.

Keep up with your payments

By avoiding late or missed payments on existing credit accounts, you show lenders you’re a reliable borrower.

Limit applications for new credit

When you apply for credit, your credit report is searched. Too many searches in a short space of time can impact your credit score. Try to avoid applying for new credit – such as a mobile phone contract or a credit card - during the six months before a mortgage application.

Limit how much credit you use

If you have a limit of £1,000 - on a credit card for example - and you’re using £500, that’s 50% of the available credit. If possible, you should try to make sure you’re using less than 30% of all the credit available to you.

Keep old accounts open

It’s good to be able to demonstrate a long credit history and show you’ve successfully managed a number of different credit accounts. Having unused credit on old accounts also helps limit the proportion of available credit you’re using.

Check your financial links to other people

If you opened a joint account with an ex-partner or previous housemates, their poor money management could impact your credit score. Check you aren’t linked to anyone who may have a negative effect on your score and ask for outdated links to be removed.

Whether you’re a first-time buyer or a homeowner looking to move, we can help find the best mortgage for you.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Key takeaways:

- A poor credit score can lead to mortgage applications being rejected.

- Check your credit report for errors and ask for any mistakes to be corrected.

- Improve your credit score by taking steps to show lenders you’re a reliable borrower.

- Professional advice can help ensure you find the best mortgage deal for your circumstances.

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.