What is the True Value of Financial Advice

Posted by Rebecca Harbrow on Thursday 26th June 2025

The value of advice – planning with purpose

In an ever-changing world, navigating your financial options can be challenging. Whether you’re thinking about ways to save, planning for retirement, considering how best to use your tax allowances, or thinking about how your estate might be passed on, it’s often hard to know where to begin. That’s where advice can make a real difference – helping you plan with clarity and purpose.

Making sense of pensions

Pensions remain one of the most effective ways to save for later life, yet, with evolvin...

The Value of Financial Advice

Posted by Rebecca Harbrow on Wednesday 11th June 2025

Whether you're buying your first home, becoming a parent, investing for the future, or approaching retirement, a carefully thought out financial plan can make a difference. This guide aims to highlight some of the typical milestones many of us will face. You can apply your own circumstances to see when financial advice would be most appropriate for you. Click on the image below to launch the PDF guide

Your First Home - 6 Key Factors that can Affect your First Mortgage Application

Posted by Rebecca Harbrow on Thursday 5th June 2025

Six key factors that can affect your first mortgage application

Applying for your first mortgage is an exciting milestone, but it can also feel overwhelming. Lenders assess numerous factors to determine your eligibility, and some seemingly minor financial decisions can significantly impact your application. To help you secure approval, here are six key areas to focus on before applying for your first mortgage.

1. Changes to outgoings

Lenders consider your affordability based on your income and regular outgoings. Making significant fi...

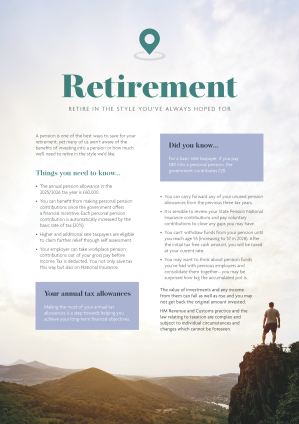

Retirement Planning

Posted by Rebecca Harbrow on Sunday 1st June 2025

Planning for retirement might seem daunting, but it doesn't have to be. To help you navigate this important process, we've outlined a simple 5-step guide. This guide will walk you through everything from understanding how much you'll need to assessing your income options and ultimately drawing up a comprehensive plan for your future.

Click on the image below to view the full document

Retirement can often seem a long way off, but the choices you make while you’re still working can have an enormous impact on the k...

Are you protecting your investment contributions?

Posted by Rebecca Harbrow on Friday 16th May 2025

Planning for the future involves more than setting money aside with financial investments and savings; it requires consistency and commitment. Yet, life's unexpected events, like illness or injury, can disrupt your investment journey. These curveballs might make it challenging to maintain your planned investment contributions.

That's why it's essential to consider how you can protect your investment contributions, ensuring they remain steady and uninterrupted if the unexpected were to happen.

Income protection is essential for your inves...

Jargon Buster: What are the key mortgage terms every first-time buyer should know?

Posted by Rebecca Harbrow on Wednesday 14th May 2025

Buying a house can certainly be a daunting experience, especially when it’s your first time doing so. What doesn’t help is the wealth of jargon and terminology used during the mortgage process and throughout the entire journey to buy your new home.

If you’re looking to join the property ladder and want to gain the inside scoop on some of the phrases, terminology and jargon you will expect to see, here is a handy guide.

Agreement in Principle (AIP)

Also known as a Decision in Principle (DIP), this is a statement from a lender to say they...

Protecting your wealth for your lifestyle and your family

Posted by Rebecca Harbrow on Wednesday 7th May 2025

In the hustle and bustle of daily life, it's easy to overlook the importance of protecting our financial security both for now and in the future.

We work hard to build a comfortable life for ourselves and our loved ones, but what happens if the unexpected happens and we become too ill to work. How can we ensure that our security today and our financial legacy remains intact for the next generation?

One of the most effective ways to protect our wealth is by incorporating income protection and critical illness cover into our financial pla...

Are you protecting your pension contributions?

Posted by Rebecca Harbrow on Friday 25th April 2025

When it comes to planning for retirement, making sure your pension contributions are on-track is important. But life can throw curveballs like illness or injury which could make it tough to keep up with contributions.

Why Income Protection matters

Income protection insurance is designed to pay a proportion of your income, approximately 60-70%, if you are unable to work due to illness or injury. This financial safety net ensures that you can continue to meet your financial obligations, including pension contributions, even if you're unable...

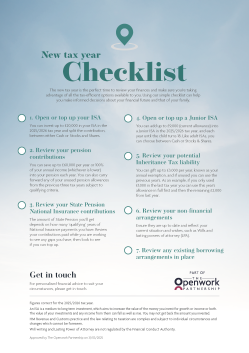

2025/26 Tax Planning

Posted by Rebecca Harbrow on Wednesday 9th April 2025

2025/26 Tax Planning is Underway

Every year brings new possibilities, and as we approach the start of the 2025/26 tax year, it's the perfect time to maximise your financial options and opportunities. Whether you're an investor or a saver, there are many tax benefits to take advantage of, and our team of experts is on hand to provide you with the information you need to make the best decisions for your finances.

What should my priorities be?

In 2025/2026, you can contribute a maximum of £20,000 across all your ISAs. This allowance applie...

Step into Pension Planning

Posted by Rebecca Harbrow on Thursday 3rd April 2025

Planning for retirement might seem daunting, but it doesn't have to be. To help you navigate this important process, we've outlined a simple 5-step guide. This guide will walk you through everything from understanding how much you'll need to assessing your income options and ultimately drawing up a comprehensive plan for your future.

Planning for retirement might seem daunting, but it doesn't have to be. To help you navigate this important process, we've outlined a simple 5-step guide. This guide will walk you through everything from understanding how much you'll need to assessing your income options and ultimately drawing up a comprehensive plan for your future.

Step 1: Don’t Put It Off

Retirement can often seem a long way off, but the choices you make while you’re still working can have an enormous impact on the kind of life you enjoy when you stop.

Our trusted and ...