Mortgage Affordability

Posted by Rebecca Harbrow on Wednesday 21st June 2023

How to improve your chances of passing a mortgage affordability assessment

Getting on the housing ladder can feel like one of the hardest and longest processes in the world and the cost of living crisis is probably not helping. You need to come across as attractive buyers for lenders to consider you, but there are many factors that can reduce how much lenders are willing to let you borrow for your home.

How do lenders decide whether to offer you a mortgage?

If you’re applying for a new mortgage, remortgaging or increasing your current mor...

5 practical ways to make your pension go further during the cost of living crisis

Posted by Rebecca Harbrow on Wednesday 14th June 2023

Five options that could help you make your pension stretch further.

Five options that could help you make your pension stretch further.

Household bills have increased rapidly during the past year. The current cost of living crisis began with the Covid pandemic, causing problems for economies around the world and creating global supply chain delays. The war in Ukraine simply heightened an already difficult situation. Following such an extended period of price rises, you may be concerned about your household finances and long-term plans. If you are retired and rely on a defined contribution (DC) pension for y...

Regular Investing

Posted by Rebecca Harbrow on Friday 9th June 2023

5 ways saving little and often could help you grow your wealth

5 ways saving little and often could help you grow your wealth

When it comes to investing your money, making small regular investments can provide more benefits than investing a lump sum. Through regular investing, you can invest a small amount into the markets every month. Investing little and often is a great habit to develop and instil in younger family members, too. Instead of saving up a chunk of money to invest in one lump sum, investing this way can make a significant difference to your overall levels of wealth over the longer term. ...

Life after your Fixed Rate mortgage: Should I remortgage when my fixed rate ends?

Posted by Rebecca Harbrow on Wednesday 7th June 2023

If you’re currently on a fixed rate mortgage (unsurprisingly, as they are the most popular mortgage at the moment)* you might be thinking that another fixed rate mortgage is the obvious choice when your current one ends.

If you’re currently on a fixed rate mortgage (unsurprisingly, as they are the most popular mortgage at the moment)* you might be thinking that another fixed rate mortgage is the obvious choice when your current one ends.

It’s understandable to see why. Fixed rate mortgages give borrowers stability – you know exactly how much you’re paying each month, for a set period of time, and can budget accordingly.

And after over a decade of low interest rates, fixed-term mortgage deals have become the go-to for many homeowners. However, this doesn’t ...

First Time Buyers Guide to Saving for a House Deposit

Posted by Rebecca Harbrow on Wednesday 17th May 2023

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation and the cost of living increases, it can be challenging trying to save a large sum of money. It’s also important to consider all the other costs that are involved in buying a property – conveyancing, legal fees, insurance policies and moving to name a few.

How much do I need to save?

A 5% deposit of the property value is the minimum amount you are able put down, however your options may be limited. The larger deposit you can p...

5 Ways to Spring Clean your Finances

Posted by Rebecca Harbrow on Wednesday 10th May 2023

The start of a new financial year is a great time to review your finances – whether it’s your savings and investments, mortgages or insurance policies.

Higher interest rates and the rapid increase in the cost of living are likely to be affecting many areas of your finances. The start of the year is the perfect time to think about any concerns you may have and to ensure you’re making the most of your money.

Savings

After many years of low rates, savings accounts have made a substantial comeback following a series of interest rate rises fro...

2023/2024 Tax Year

Posted by Rebecca Harbrow on Thursday 27th April 2023

Start of the tax year checklist

The new tax year commenced on 6 April 2023 so its a great time to review your finances.

The new tax year means annual allowances are reset and ready to be reused – to help you make the most of your money. This year more than ever, with interest rates and inflation on the rise, it’s a great time to review your pensions and investments.

Note: The following figures apply to the 2023/2024 tax year, which starts on 6 April 2023 and ends on 5 April 2024.

ISAs

The maximum you can invest across your ISAs is £20,0...

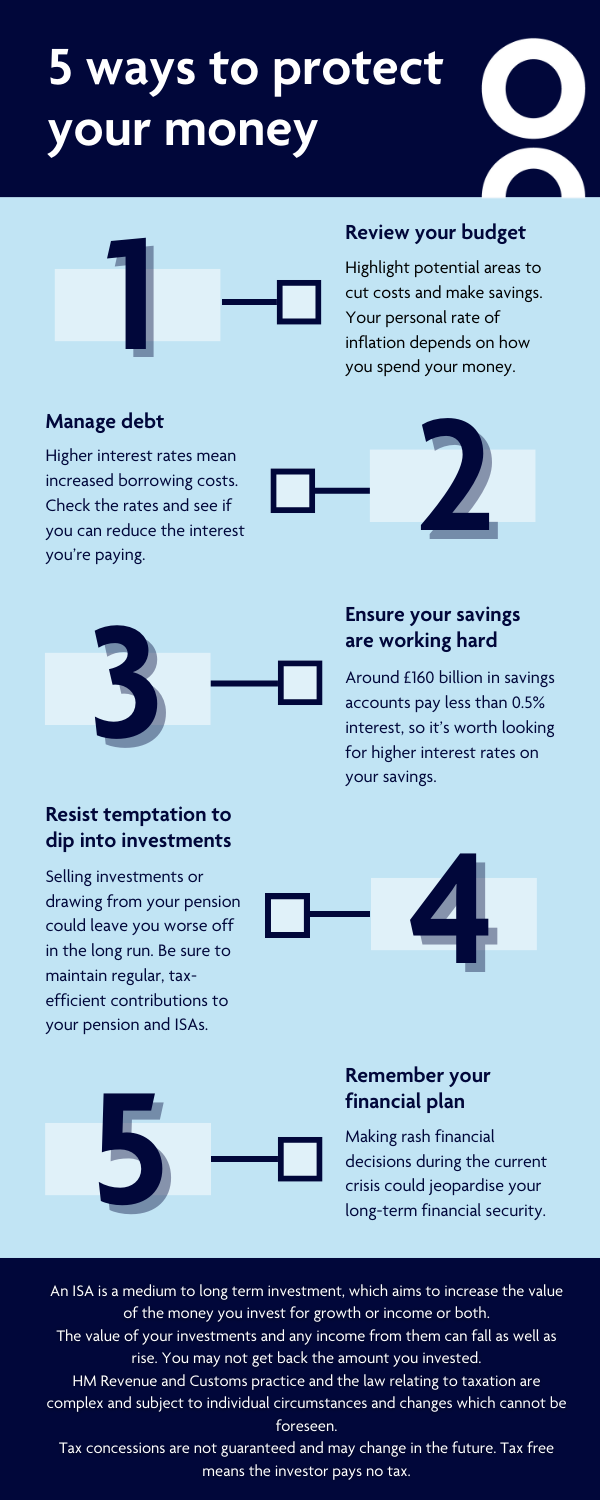

5 Ways to Protect your Money

Posted by Rebecca Harbrow on Friday 31st March 2023

Five practical ways to protect your money during the cost of living crisis

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021.

While the Covid pandemic began the inflationary increase, this was further exacerbated by the war in Ukraine pushing up energy and food prices even further.

Following such an extended period of price rises, you may be concerned about your household finances and long-term...

Podcast

Posted by Rebecca Harbrow on Tuesday 28th March 2023

How to take control of your finances as a woman business owner

Five practical reasons you should create a financial plan with your partner

Posted by Rebecca Harbrow on Wednesday 22nd March 2023

Money and financial goals are still sometimes viewed as taboo subjects, even within relationships. If you’ve been putting off conversations about finances, creating a plan together could have many benefits.

Money and financial goals are still sometimes viewed as taboo subjects, even within relationships. If you’ve been putting off conversations about finances, creating a plan together could have many benefits.

Actively talking about money can be positive for both you and your loved ones, and research suggests it’s something younger generations are more likely to do. According to Royal London, 76% of 18 to 24-year-olds spoke to their parents about money matters when they were growing up. In contrast, this falls to 43% for those over 65.

If mon...