Talking to kids about the value of money

Posted by Rebecca Harbrow on Wednesday 5th October 2022

After seeing their six-year-old son’s birthday list, Liz and Dan have realised it’s high time they started teaching Archie about the value of money. It’s true they both have reasonably well-paid jobs and only the one child but, even so, a Saint Bernard puppy, a quad bike, a horse and a life-size dalek don’t come cheap. So, what can Liz and Dan do to ensure Archie doesn’t end up bankrupting them before he goes to high school?

After seeing their six-year-old son’s birthday list, Liz and Dan have realised it’s high time they started teaching Archie about the value of money. It’s true they both have reasonably well-paid jobs and only the one child but, even so, a Saint Bernard puppy, a quad bike, a horse and a life-size dalek don’t come cheap. So, what can Liz and Dan do to ensure Archie doesn’t end up bankrupting them before he goes to high school?

Pocket money

Archie is nearly seven - the age when most parents start giving their children pocket money, according ...

Saving for a Mortgage

Posted by Rebecca Harbrow on Wednesday 28th September 2022

First time buyers guide to saving for a deposit

First time buyers guide to saving for a deposit

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation, cost of living and mortgage rates increase, it can mean that some mortgage lenders may require larger deposits of the property value. This can be challenging trying to save a large sum of money and for some within a limited time. According to the Office for National Statistics, the average UK house price was £277,000 in February 2022, which is £27,000 higher than this time last...

Seeking Investment Talent

Posted by Rebecca Harbrow on Friday 26th August 2022

We explore how Omnis appoints third-party managers to run funds to provide access the best investment talent in the market.

We explore how Omnis appoints third-party managers to run funds to provide access the best investment talent in the market.

Omnis Investments (Omnis) offers clients of The Openwork Partnership and 2plan Wealth Management a range of 26 funds. They appoint third-party investment managers, allowing investors access to the best talent in the market. No matter how big you are as an investment house, you can’t have the best investment managers for every single asset class – it is Omnis’ job to find the best managers out there.

Investment manager...

How to protect your business

Posted by Rebecca Harbrow on Wednesday 24th August 2022

What is business protection insurance and how does it work? Find out why it could be right for your business.

What is business protection insurance and how does it work? Find out why it could be right for your business.

If you own or run a small business, protecting it is always a priority, especially if something were to happen to a key member, which could affect the financial health of the company. In this situation, business protection insurance could provide some peace of mind.

What is business protection?

Business protection provides coverage in the event that a director, business partner or other key employee of your business suffers a crit...

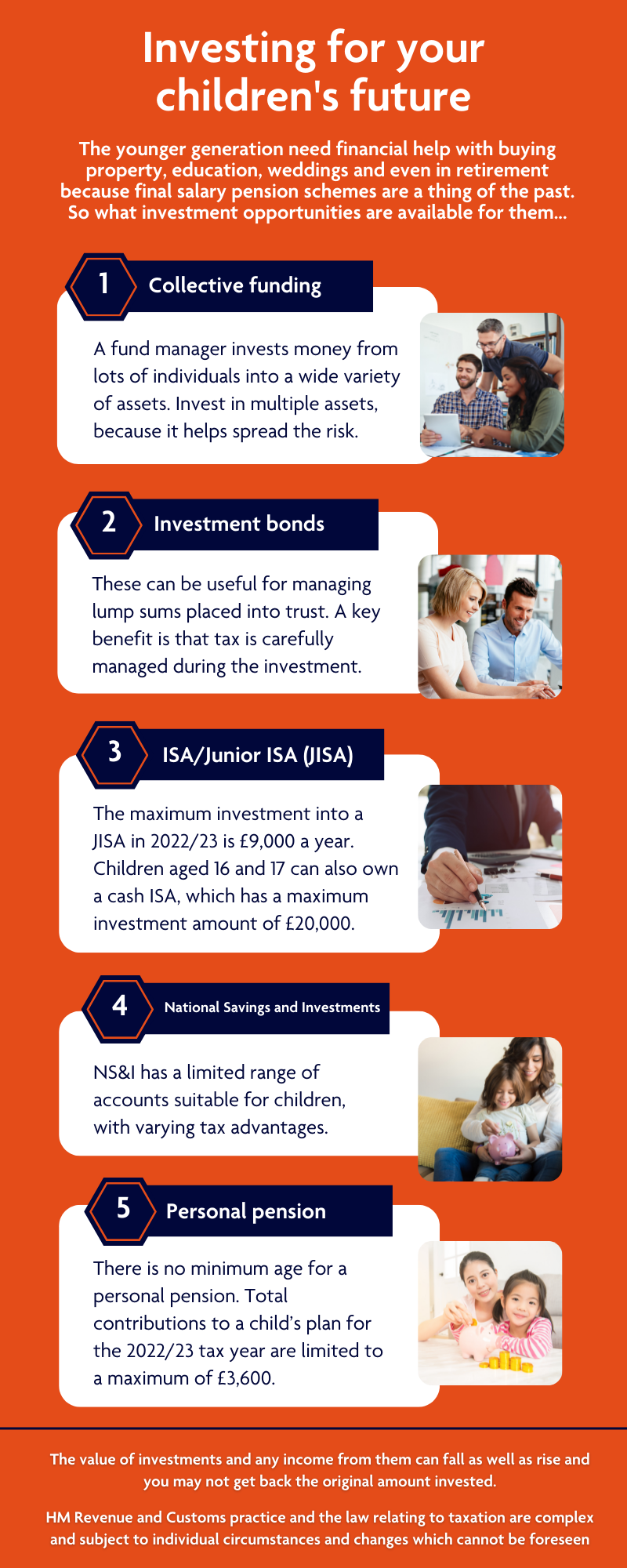

Investing for your children's future

Posted by Rebecca Harbrow on Friday 19th August 2022

As parents to four children ranging in age from three to 12 years old, Rachel and Samantha were horrified to hear on the news that a quarter of 20-to-34 year olds still live at home with their parents. As much as they love their kids, the idea they might still be a permanent fixture around the house into their 30s terrifies them.

As parents to four children ranging in age from three to 12 years old, Rachel and Samantha were horrified to hear on the news that a quarter of 20-to-34 year olds still live at home with their parents. As much as they love their kids, the idea they might still be a permanent fixture around the house into their 30s terrifies them.

Are Rachel and Samantha right to be concerned?

The short answer to this is yes! Research by Civitas has indeed found that a quarter of 20-to-34 year olds still live with their parents – a million more than two dec...

10 ways to reduce your tax bill

Posted by Rebecca Harbrow on Wednesday 10th August 2022

Being tax smart means knowing the basics about how tax affects your life and money. Here are 10 ways to reduce your tax bill, which could make your money go further for you and your loved ones.

Being tax smart means knowing the basics about how tax affects your life and money. Here are 10 ways to reduce your tax bill, which could make your money go further for you and your loved ones.

Personal savings allowance

You’re entitled to receive some interest on your savings tax-free every year, depending on your income tax band. For non-taxpayers or basic rate taxpayers you’re allowed up to £1,000 per year; for higher rate taxpayers you get £500. If you have savings with a spouse or partner, you can each use your allowances against your...

How does a remortgage work?

Posted by Rebecca Harbrow on Friday 5th August 2022

A remortgage is the process of moving your home’s existing mortgage to one with a new lender. Remortgaging could help you save money if you weigh up the fees involved with the savings you could make. Here’s how it works.

A remortgage is the process of moving your home’s existing mortgage to one with a new lender. Remortgaging could help you save money if you weigh up the fees involved with the savings you could make. Here’s how it works.

People remortgage for many different reasons, including:

- Finding a better deal elsewhere – you might be on a standard variable rate (SVR) and want to move to a fixed-term rate.

- Coming to the end of a fixed-term deal on your current mortgage and wanting to lock in a lower rate with a new lender.

- The loan-to-value on the...

Budgeting Tips for Saving Money While Making your Life Better

Posted by Rebecca Harbrow on Friday 29th July 2022

Whether you want to go on holiday or just want to save some money for the future, budgeting is a good way to put aside some money for reaching this goal. Here you can find some tips to help you take control of your finances.

Why is budgeting so important?

You might think it’s not worth spending that much time counting all your income and expenses. But if you use apps or spreadsheets to make it visible how much you earn and spend on average every month, it will pay off.

In case of the unexpected or just having a big expense, it’s importa...

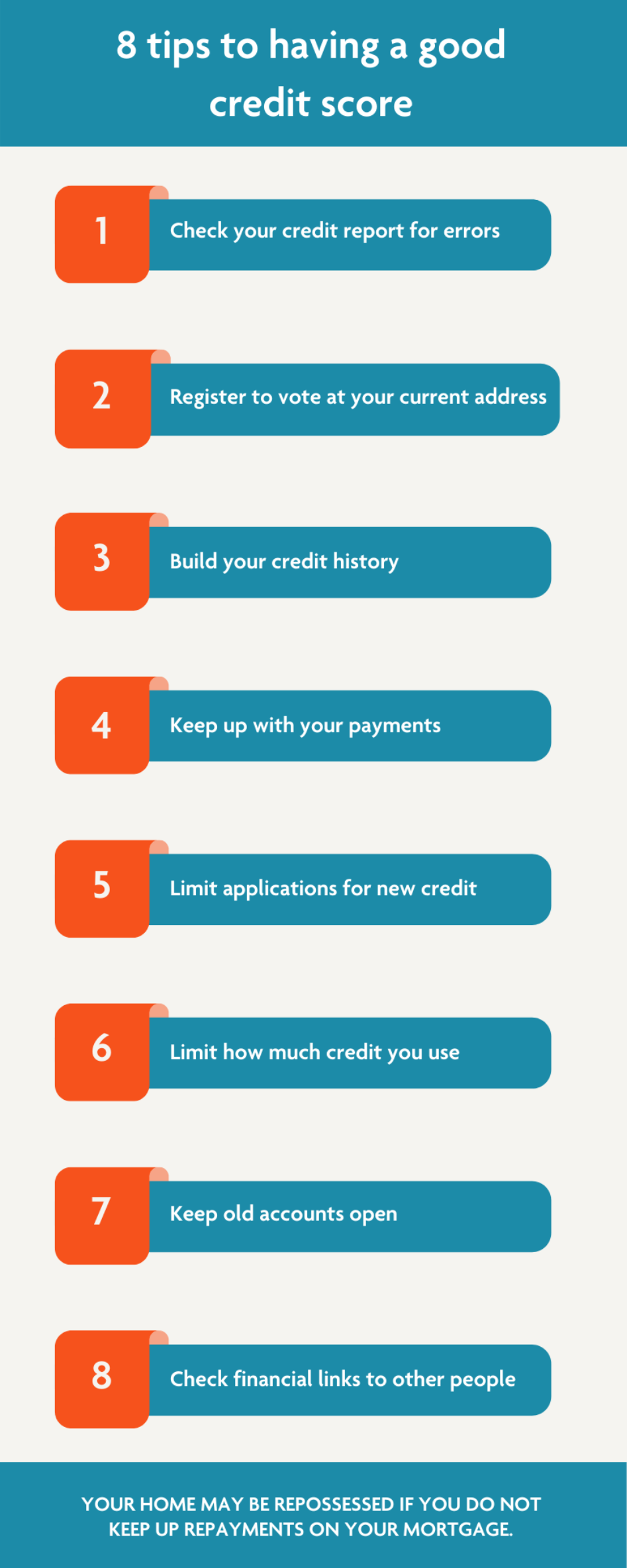

Why homebuyers need to check their credit score

Posted by Rebecca Harbrow on Friday 22nd July 2022

Carly and Steve made serious sacrifices to save a deposit for their first home. To cut costs, they moved from their two-bedroomed flat in the centre of Manchester to a studio flat in one of the less well-regarded suburbs. When the damp and the noisy neighbours got too much, they moved in with Steve’s mum and when her questions about when they were going to start a family got too much, they moved in with Carly’s big sister.

As well as moving home three times in the space of a year, Carly and Steve gave up takeaways, holidays and their gym ...

Pension Planning for the Self Employed

Posted by Rebecca Harbrow on Wednesday 20th July 2022

Pension Planning For The Self-Employed

There are 4.8 million self-employed people in the UK and only a third have any kind of pension arrangement. A shocking statistic when you consider that State support is shrinking and we’re all living longer.

Of course, saving for a pension when you’re self-employed is not as straightforward as it is for an employed person, who might automatically benefit from a workplace scheme and employer contributions. We’ve outlined some key points below for you to consider:

Don’t rely on the State Pension

Whe...