Investments and Sustainability

Posted by Rebecca Harbrow on Wednesday 13th July 2022

Investments & Sustainability

Here is the 2022 edition of the Omnis guide to responsible investing, which sets out their approach to incorporating environmental, social and governance (ESG) factors into their processes.

Saving for a University Education

Posted by Rebecca Harbrow on Friday 8th July 2022

Funding your child's university education

Sarah and Andrew’s 10-year-old twins, Isabelle and Isaac, couldn’t be more different. While Isabelle is boisterous and full of beans, Isaac is gentle and reserved. The children do have one thing in common though - they’re both extremely bright and they already know exactly what they want to do when they grow up. Isabelle loves animals and wants to be a vet, and Isaac is a very talented artist and has his heart set on art school.

When they found out they were getting two for one, Sarah and Andrew ...

Accident Protection

Posted by Rebecca Harbrow on Wednesday 6th July 2022

How would you manage if an accident stopped you working?

Matt was delighted when he landed his dream job as a football coach. He got to do what he loved every day. Life was good until, one day, he fell down the stairs and everything changed. Matt seriously hurt his back in the fall and now struggles to stand for any length of time. As a result, he needs regular physio and hasn’t been able to work since the accident. Managing the pain and being unable to do the job he loves is hard enough but his situation is made worse by the fact he is now...

Matt was delighted when he landed his dream job as a football coach. He got to do what he loved every day. Life was good until, one day, he fell down the stairs and everything changed. Matt seriously hurt his back in the fall and now struggles to stand for any length of time. As a result, he needs regular physio and hasn’t been able to work since the accident. Managing the pain and being unable to do the job he loves is hard enough but his situation is made worse by the fact he is now...

The Value of Mortgage Advice

Posted by Rebecca Harbrow on Friday 1st July 2022

Mortgages - Sorting the fact from the fiction

Lindsay and Sam have just found out they’re expecting their first baby. Although they’re excited at the prospect of starting a family, it’s come as a bit of a surprise and their current living situation is far from ideal. They’ve been staying with Lindsay’s dad in his two-bedroomed terrace for just over a year while they save up a deposit for their first house. The lack of space and privacy has proved challenging to say the least. Adding a baby into the mix seems like a terrible idea.

On t...

Introducing the Omnis Managed Portfolio Service (OMPS)

Posted by Rebecca Harbrow on Wednesday 29th June 2022

How does OMPS work?

Our informative video explains the journey our clients take when deciding to invest in one of our OMPS portfolios. Learn more about the building blocks for the portfolios and funds which are managed by some of the world’s leading investment managers, who we’ve carefully selected.

The value of financial advice

Posted by Rebecca Harbrow on Wednesday 8th June 2022

Financial advice isn’t just for the super-rich with complex tax situations and offshore bank accounts. It can be invaluable for anyone with financial goals.

Whether you're saving for your future, buying your first home, remortgaging or want to protect your home and income – speaking to an expert can make all the difference.

Saving for your future

Robyn and Tim met in their late 20s and soon got married. They were keen to get on the property ladder so spoke to a financial adviser who helped them form a savings strategy.

They both opened...

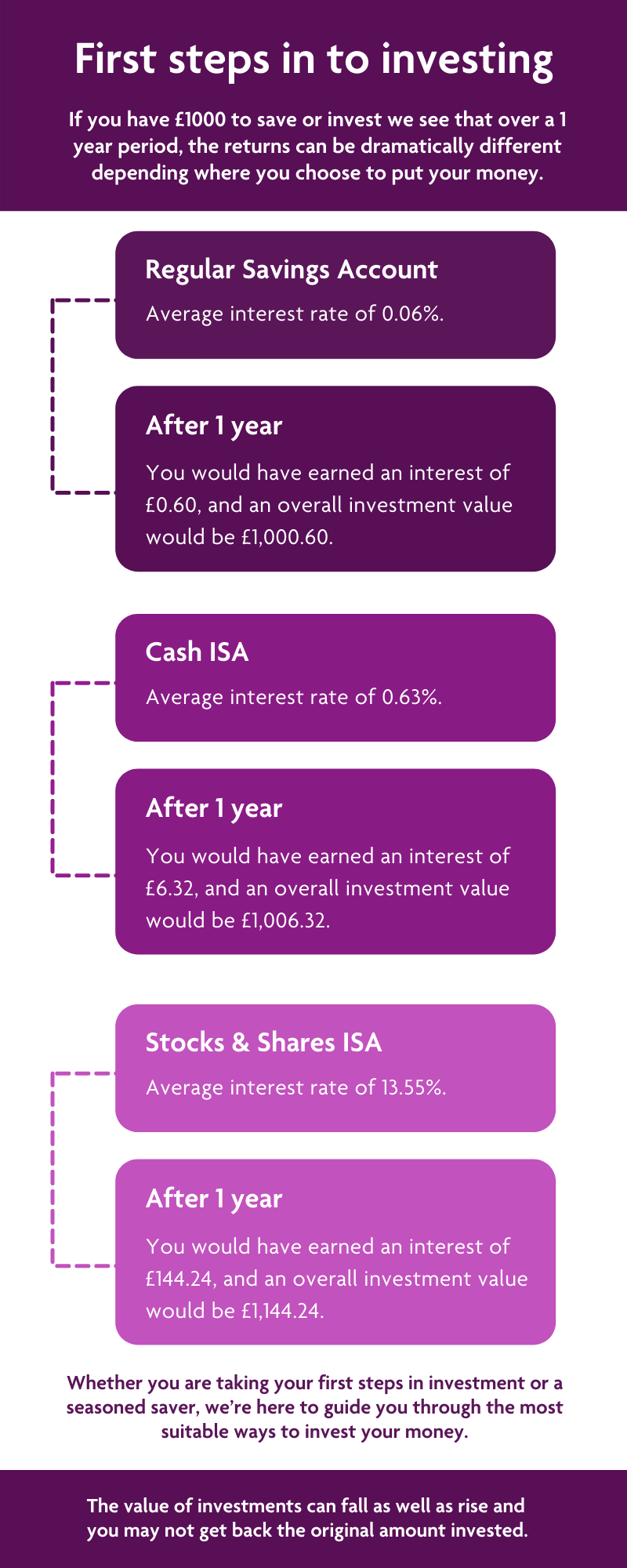

First steps to investing

Posted by Rebecca Harbrow on Friday 3rd June 2022

There is no right time to begin investing but there are some decisions to make that could affect your returns. If you are 7 years old and saving your pocket money for a PS5, 17 saving the money from your first job for a car, 27 saving for your first house or 57 and finalising your retirement plans which include a dream holiday, we can provide personalised advice for you.

Angela was looking at ways she could reduce her inheritance tax. After spending some time researching, she realised she could make small gifts to as many people as she li...

Planning for a comfortable retirement

Posted by Rebecca Harbrow on Wednesday 1st June 2022

Tina is a fit and vibrant 59-year-old who expected retirement to offer a whole new lease of life. She was looking forward to using her increased leisure time to explore Europe while indulging her passion for climbing. However, after going through her finances, she’s now concerned she won’t be able to afford her monthly bills let alone pay for trips abroad.

Tina has always managed her day-to-day finances really well, but she never sat down and worked out how much she’d need for a comfortable retirement. A 2021 Which survey found that a ret...

Have you considered re-mortgaging?

Posted by Rebecca Harbrow on Friday 13th May 2022

Could remortgaging help you beat the cost-of-living crisis?

Practically every penny of Mike’s monthly salary is accounted for so, as the cost-of-living crisis starts to bite, he’s worried about making ends meet. He’s started shopping around for cheaper deals on his broadband, mobile-phone contract, and car insurance, and he’s also cancelled his gym membership and a couple of his TV subscriptions. But he’s overlooked the bill offering the largest potential saving – his mortgage.

Practically every penny of Mike’s monthly salary is accounted for so, as the cost-of-living crisis starts to bite, he’s worried about making ends meet. He’s started shopping around for cheaper deals on his broadband, mobile-phone contract, and car insurance, and he’s also cancelled his gym membership and a couple of his TV subscriptions. But he’s overlooked the bill offering the largest potential saving – his mortgage.

What is remortgaging?

Remortgaging involves taking out a new ...

Why Co-habiting Couples Should Make a Will

Posted by Rebecca Harbrow on Wednesday 11th May 2022

When Tom and Pete bought their first property together, life couldn’t have been better. They both had good jobs pulling in decent salaries and were excited about spending the rest of their lives together.

When Tom and Pete bought their first property together, life couldn’t have been better. They both had good jobs pulling in decent salaries and were excited about spending the rest of their lives together.

They chatted about making a will a few times, but somehow life always got in the way. Until one day, 10 years after moving in together, Pete got a call that would change his life forever – Tom had been killed in a car accident.

The intestacy trap

On top of grieving for his partner, Pete found he was also facing an uncertain financial fut...