The 2023 Autumn Statement: Winners and Losers

Posted by Rebecca Harbrow on Wednesday 22nd November 2023

UK Chancellor Jeremy Hunt’s 2023 Autumn Statement outlined, in his words, “eight months of hard work” and no fewer than 110 measures to help grow the British economy. Contained within are a raft of measures set to overhaul everything from minimum wage and benefit payments to tax, business investment, and more.

The Winners

Young and low-paid staff

Although the news was released ahead of the main statement, the announcement confirmed a large-scale increase to the national living wage, bringing the hourly rate from £10.42 to £11.44 (an impr...

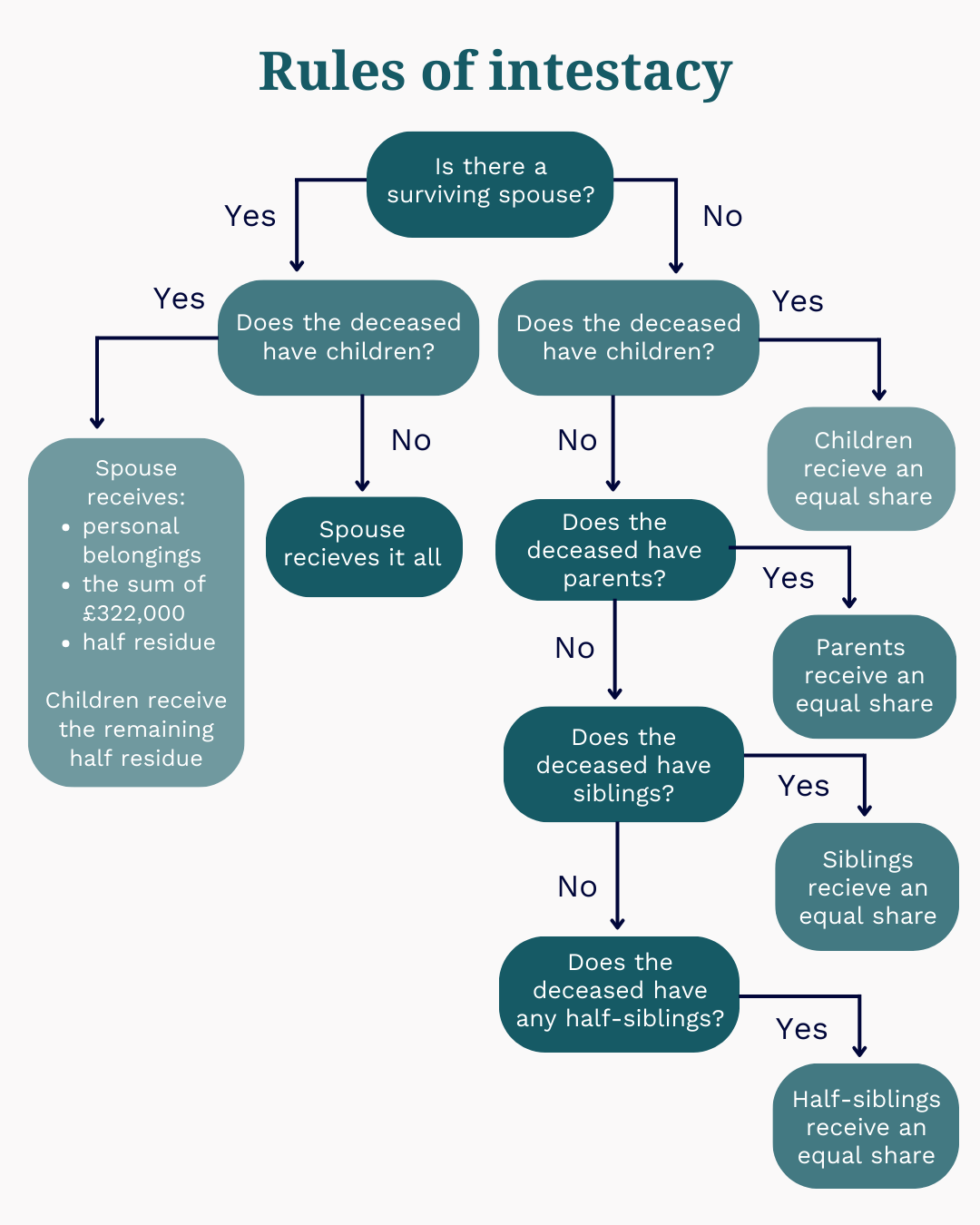

What are the rules of intestacy?

Posted by Rebecca Harbrow on Wednesday 15th November 2023

Regular investing

Posted by Rebecca Harbrow on Friday 10th November 2023

5 ways saving little and often could help you grow your wealth

When it comes to investing your money, making small regular investments can provide more benefits than investing a lump sum.

When it comes to investing your money, making small regular investments can provide more benefits than investing a lump sum.

Through regular investing, you can invest a small amount into the markets every month. Investing little and often is a great habit to develop and instil in younger family members. Instead of saving up a chunk of money to invest in one lump sum, investing this way can make a significant difference to your overall levels of wealth over the longer term.

One...

Is now a good time to remortgage as the Bank of England base rate stays the same?

Posted by Rebecca Harbrow on Wednesday 8th November 2023

Whilst the Bank of England base rate remains the same, interest rates are still the highest they have been in 15 years. So if you are one of the thousands coming to the end of your fixed rate deal over the next few months it’s very likely you’ll see your payments increase as a result of higher mortgage rates but it’s a common misunderstanding that the Bank of England base rate is directly linked to the mortgage rates on offer. There are many factors that determine mortgage rate pricing.

Whilst the Bank of England base rate remains the same, interest rates are still the highest they have been in 15 years. So if you are one of the thousands coming to the end of your fixed rate deal over the next few months it’s very likely you’ll see your payments increase as a result of higher mortgage rates but it’s a common misunderstanding that the Bank of England base rate is directly linked to the mortgage rates on offer. There are many factors that determine mortgage rate pricing.

Lots of factors determine mortgage pricing – not just ...

5 practical ways to make your pension go further during the cost of living crisis

Posted by Rebecca Harbrow on Wednesday 1st November 2023

Five options that could help you make your pension stretch further.

Household bills have increased rapidly during the past year. The current cost of living crisis began with the Covid pandemic, causing problems for economies around the world and creating global supply chain delays followed by the war in Ukraine.

Following such an extended period of price rises, you may be concerned about your household finances and long-term plans. If you are retired or about to retire and rely on a defined contribution (DC) pension for your income, read...

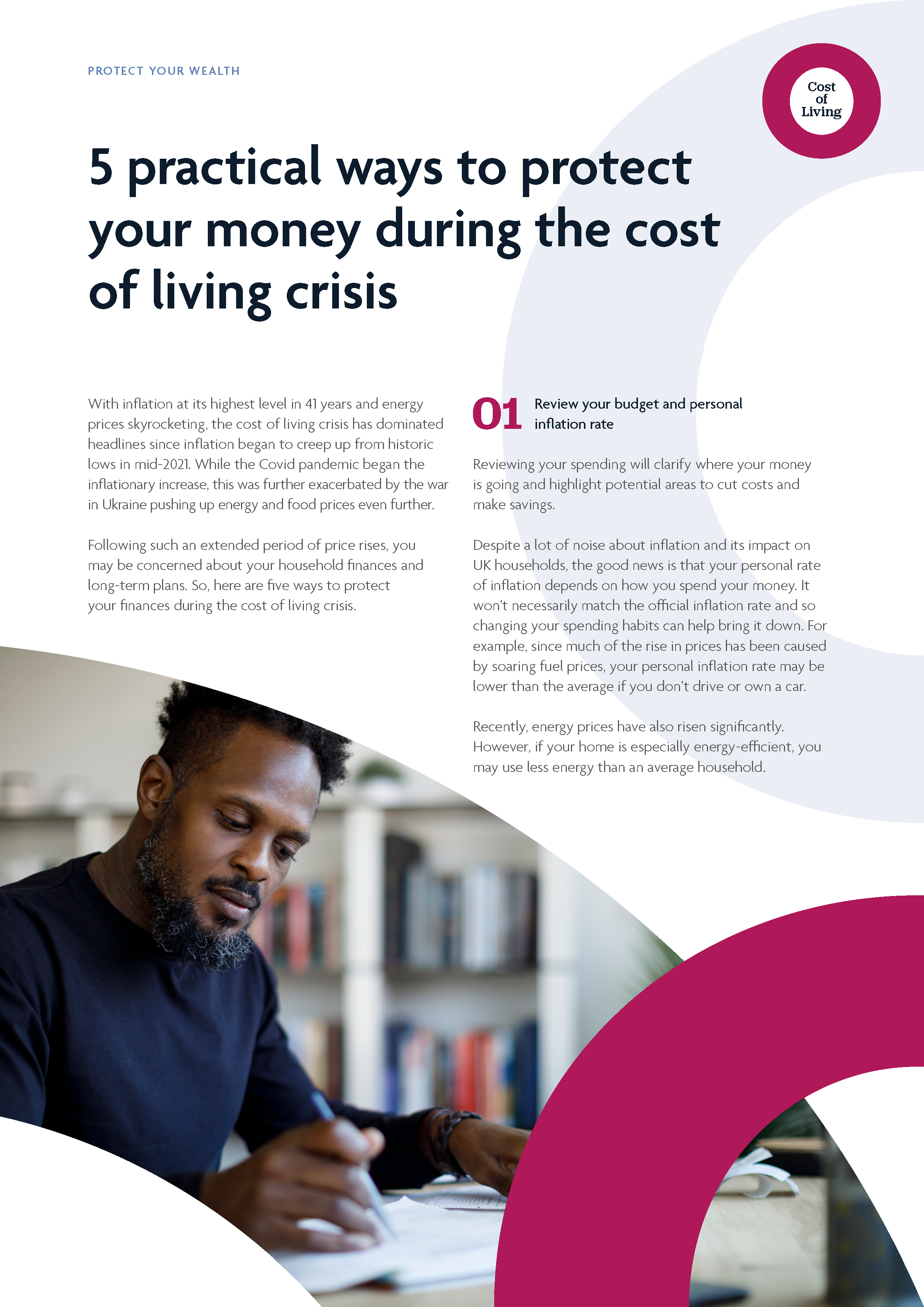

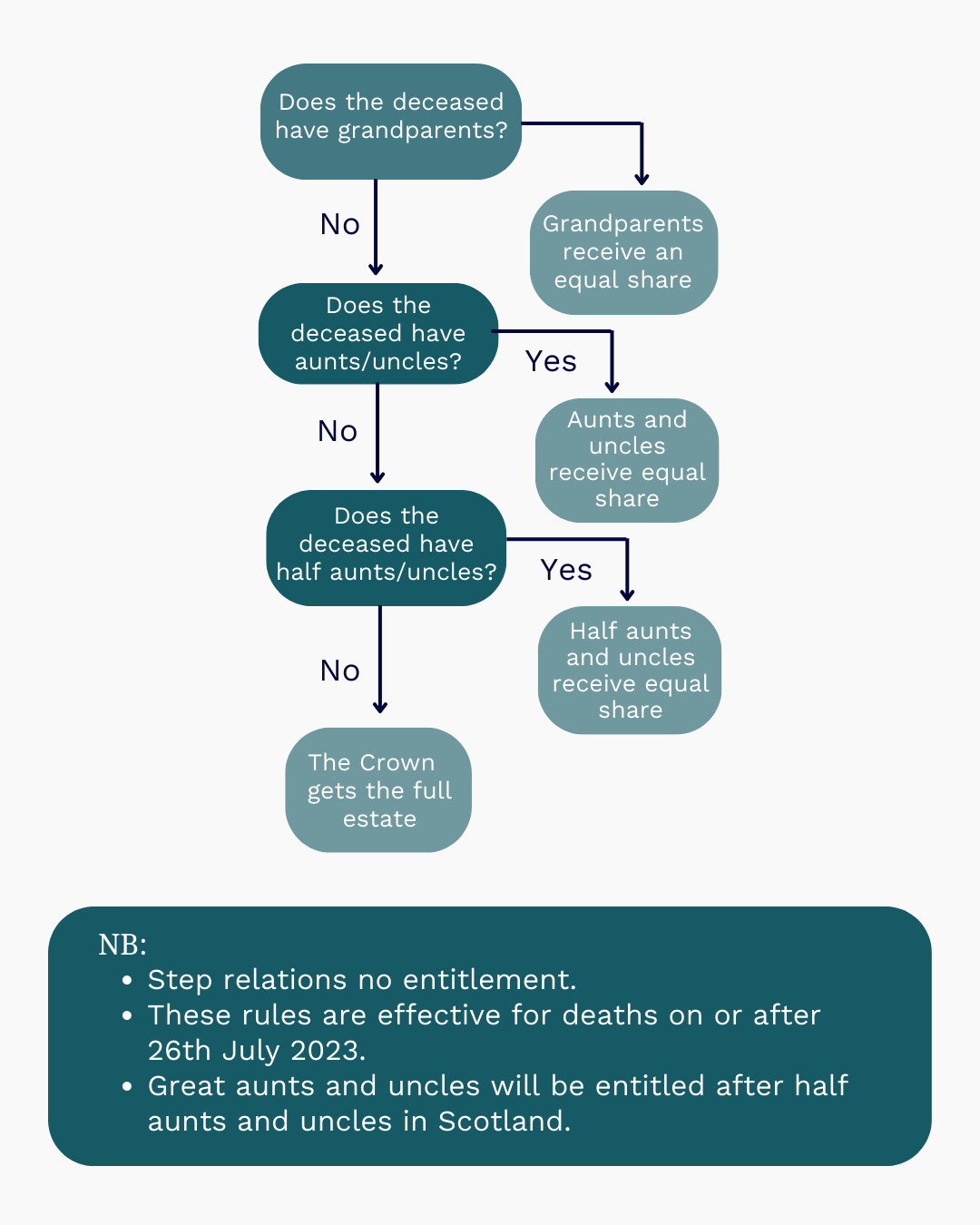

Five practical ways to protect your money during the cost of living crisis

Posted by Rebecca Harbrow on Friday 27th October 2023

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021. While the Covid pandemic began the inflationary increase, this was further exacerbated by the war in Ukraine pushing up energy and food prices even further. Following such an extended period of price rises, you may be concerned about your household finances and long-term plans. So, here are five ways to protect your finances during the cost of...

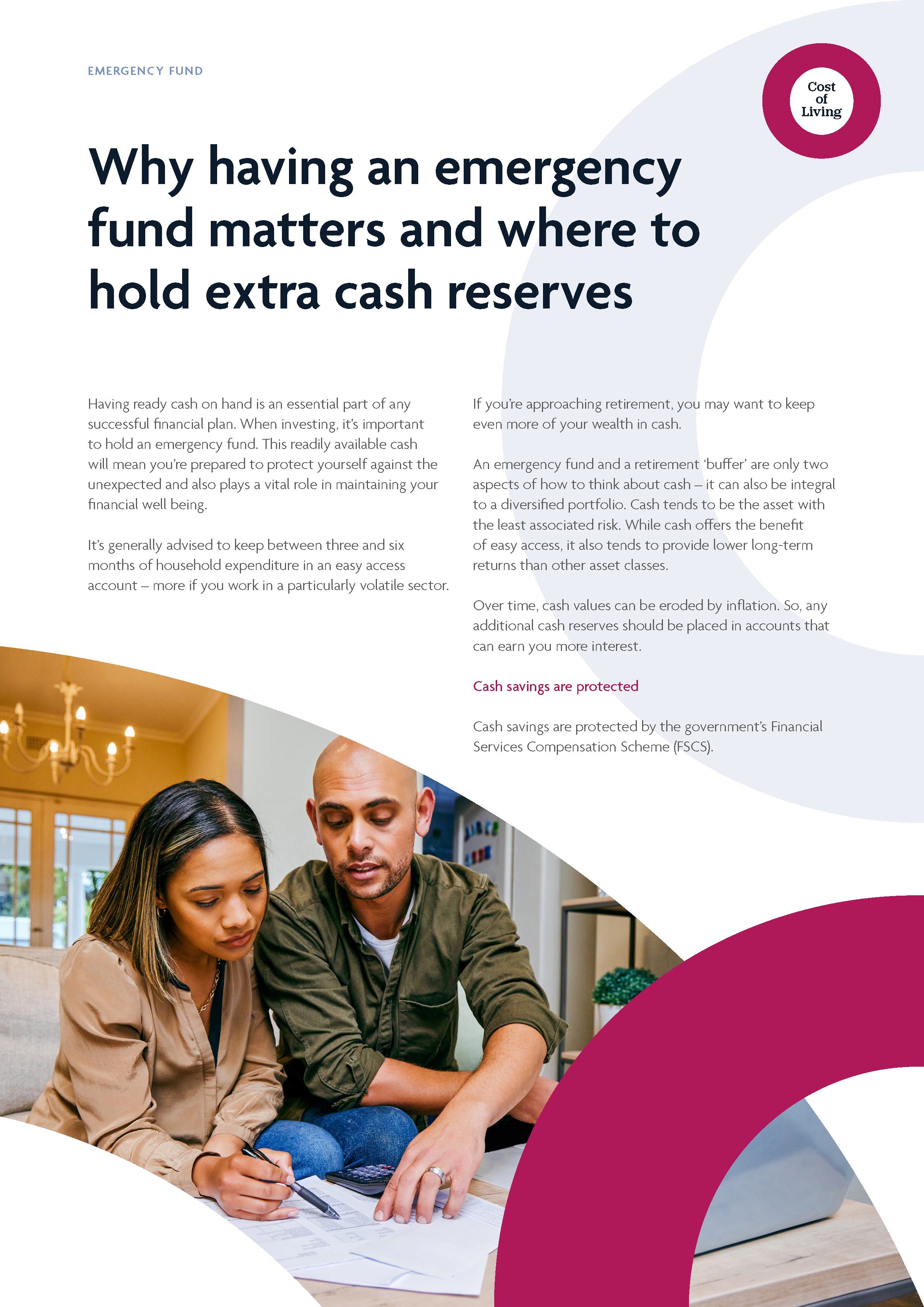

Why having an emergency fund matters and where to hold extra cash reserves

Posted by Rebecca Harbrow on Wednesday 25th October 2023

Having ready cash on hand is an essential part of any successful financial plan. When investing, it’s important to hold an emergency fund. This readily available cash will mean you’re prepared to protect yourself against the unexpected and also plays a vital role in maintaining your financial wellbeing.

It’s generally advised to keep between three and six months of household exp...

Why a plan is crucial when you start to spend your wealth

Posted by Rebecca Harbrow on Friday 20th October 2023

Reaching retirement is like reaching a summit and decumulation can present dangers. After savings for years, planning before you spend your wealth is crucial.

Reaching retirement is like reaching a summit and decumulation can present dangers. After savings for years, planning before you spend your wealth is crucial.

Making your retirement savings last a lifetime

To help ensure a sustainable income, you first need to understand how much you’ll need to live on.

- On the go – during the early stages of retirement, there’s a strong likelihood that you’ll spend more on travel, hobbies, or home improvements

- Slowing down – while you may be slightly less active, you’re still busy with hobbies, but you...

Is Drawdown Right for You? Two Important Questions to Consider

Posted by Rebecca Harbrow on Wednesday 18th October 2023

If you have a defined contribution pension, you can access your retirement savings in a variety of ways. One of those options is drawdown – a flexible approach for dipping into your savings when you need to. Read on to learn more about it.

1. How much income are you likely to need throughout your retirement?

Your specific circumstances will influence how much income you need through retirement and the method you use to access your pension savings. Cashflow modelling can help you to see if your savings are sufficient to support you throug...

Remortgaging as a landlord: what to consider with a Buy to Let mortgage

Posted by Rebecca Harbrow on Sunday 15th October 2023

If you’re looking for a Buy to Let mortgage in the current economic climate, the prospect may feel a little daunting. There’s no denying that as a landlord, due to remortgage, you may be facing higher mortgage rates and monthly payments which could put a squeeze on your profits.

But an adviser can help you navigate the difficulties, with the tools and expertise to source a Buy to Let mortgage that works for you.

To help set you up before you speak to an adviser, we’ve put together a useful breakdown of the key information you’ll need ...