First-time buyers guide to saving for a house deposit

Posted by Rebecca Harbrow on Friday 3rd May 2024

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation, cost of living and mortgage rates increase, it can mean that some mortgage lenders may require larger deposits of the property value. This can be challenging trying to save a large sum of money and for some within a limited time. It’s also important to consider all the other costs that are involved in buying a property – conveyancing, legal fees, insurance policies and moving costs to name a few.

How much do I need to save?...

Do you keep meaning to sort out your will? We can help you

Posted by Rebecca Harbrow on Friday 26th April 2024

Life is busy, we get it. But is anything more important than being in control of your future? Recent research* suggests that only 44% of UK adults have made a will, which means that you’re far from alone if you haven’t yet got around to completing what, for some, appears to be a daunting task.

Life is busy, we get it. But is anything more important than being in control of your future? Recent research* suggests that only 44% of UK adults have made a will, which means that you’re far from alone if you haven’t yet got around to completing what, for some, appears to be a daunting task.

It’s always worth bearing in mind that if you die without a will, the law decides who inherits everything you own (your assets) according to certain criteria called ‘intestacy rules’. So your assets may not be divided up as you would like, meaning you...

What is a Lasting Power of Attorney and do I need one?

Posted by Rebecca Harbrow on Wednesday 24th April 2024

What is a Lasting Power of Attorney (LPA) and do I need one?

What is a Lasting Power of Attorney (LPA) and do I need one?

A Lasting Power of Attorney (LPA) is a legal document that allows you to appoint one or more people to make decisions on your behalf during your lifetime. The people you appoint to manage your affairs are called the attorneys. An LPA is a completely separate legal document to your will although many people put them in place at the same time as getting their will written, as part of planning for their future.

What does a Lasting Power of Attorney (LPA) cover?

There are two types ...

Overpaying your mortgage

Posted by Rebecca Harbrow on Friday 19th April 2024

Hardly a day goes by without the cost of living hitting the headlines. For many homeowners the increasing costs of owning and running a home is having a huge impact on household budgets. Even if you are near the top end of your monthly budget, or are expecting a ‘payment shock’ when you come to remortgage next, you may be wondering whether it’s worthwhile paying more than the minimum repayment each month, with the aim to save money in the long run.

Hardly a day goes by without the cost of living hitting the headlines. For many homeowners the increasing costs of owning and running a home is having a huge impact on household budgets. Even if you are near the top end of your monthly budget, or are expecting a ‘payment shock’ when you come to remortgage next, you may be wondering whether it’s worthwhile paying more than the minimum repayment each month, with the aim to save money in the long run.

So, what are the benefits of making mortgage overpayments?

1 Mortgage-free sooner

Over...

BLOG - The effect of psychology on investors

Posted by Rebecca Harbrow on Wednesday 10th April 2024

You should base financial decisions on logic and facts. But psychology can have a much larger effect than you think, and it can lead to you making decisions that aren’t right for you. Read on to find out more about what behavioural finance is and how it could affect you.

You should base financial decisions on logic and facts. But psychology can have a much larger effect than you think, and it can lead to you making decisions that aren’t right for you. Read on to find out more about what behavioural finance is and how it could affect you.

“Behavioural finance” was first coined in the 1970s by economist Robert Shiller and psychologists Daniel Kahneman and Amos Tversky. They used the term to refer

to how unconscious biases and previous experiences affect the way people make financial decisions.

It can be use...

Pension Consolidation

Posted by Rebecca Harbrow on Wednesday 20th March 2024

Jenny is a 47-year-old Account Manager with a long and varied CV.

Jenny is a 47-year-old Account Manager with a long and varied CV.

She hasn’t quite had more jobs than hot dinners but, when she thinks about the various pensions she’s acquired over the years, sometimes it feels that way.

Jenny has recently been considering consolidating pensions. But is combining her pensions necessarily the best way forward?

There are several potential advantages of consolidating your pensions.

Easier to manage - One of the main advantages Jenny might gain by combining her pensions is it should be easier for her to man...

Preparing for retirement: the road to financial freedom

Posted by Rebecca Harbrow on Friday 8th March 2024

Retirement isn’t just about sipping cocktails on a beach; it’s about having the financial security to do so. Fortunately, there are plenty of ways to pave your way to financial freedom when it comes to your time to retire. However, it requires you to put in the work as the amount of money you need, will depend on the type of lifestyle you are picturing for yourself.

Start with a private pension

A private pension is a separate plan you can set up for yourself, where you contribute from your earnings, which pays you a pension after retirem...

Spring Budget 2024: Winners and Losers

Posted by Rebecca Harbrow on Wednesday 6th March 2024

At 12.30pm today, Chancellor of the Exchequer Jeremy Hunt announced the UK Spring Budget, as well as the economic and fiscal forecast by the Office of Budget Responsibility.

These legislative announcements are game-changers for Britain's economy, and Hunt’s announcements included a number of sweeping changes that could potentially affect the personal finances of everyone living and working in the United Kingdom.

In laying out the Spring Budget, Hunt reinforced the government’s dedication to building the British economy while also helping...

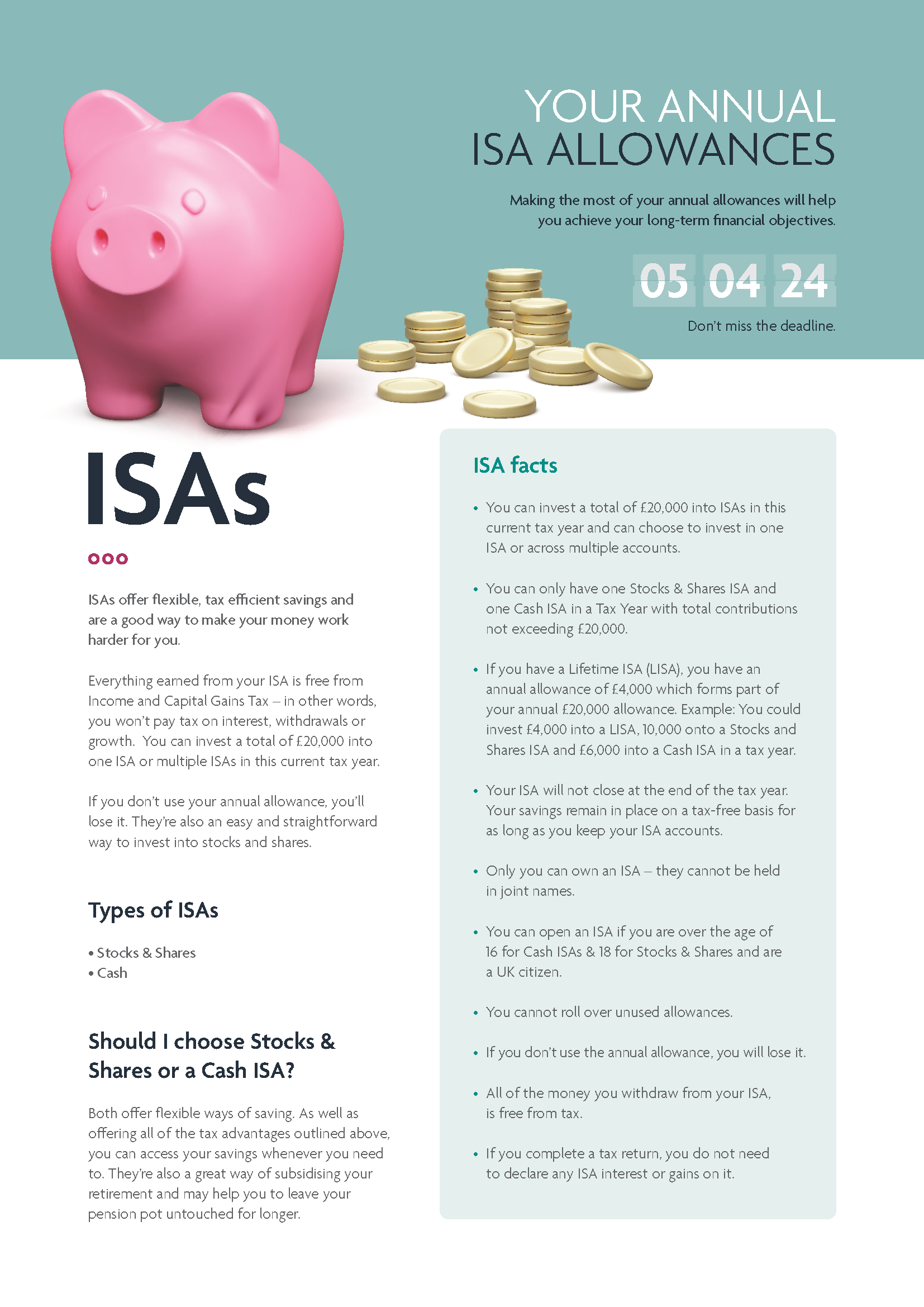

Your Annual ISA Allowances

Posted by Rebecca Harbrow on Wednesday 28th February 2024

ISAs offer flexible, tax efficient savings and are a good way to make your money work harder for you. Take a look at this latest information (select the image to view all pages)

An ISA is a medium to long term investment, which aims to increase the value of the money you invest for growth or income or both. The value of your investments and any income from them can fall as well as rise. You may not get back the amount you invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individu...

End of Year Tax Checklist

Posted by Rebecca Harbrow on Wednesday 21st February 2024

As we approach the end of the tax year, it's a good time to start thinking about how to make the most of the tax reliefs and allowances you’re entitled to, before they are lost. We’ve put together a checklist to ensure you’re aware of all the ways to make sure you don’t miss out.

As we approach the end of the tax year, it's a good time to start thinking about how to make the most of the tax reliefs and allowances you’re entitled to, before they are lost. We’ve put together a checklist to ensure you’re aware of all the ways to make sure you don’t miss out.

Open or top up your ISA

You can hold up to £20,000 in your ISA in the 2023/2024 tax year and split the contribution, between either a Cash ISA or Stocks and Shares ISA.

Use your pension allowance

Usually if you’re under 75 can contribute to a pension and receive...